IS PVC LAMINATE, A MUST SELL PRODUCT FOR RETAILERS POST COVID?

PVC laminate is slowly yet gradually gaining greater acceptance in the surface decor application in kitchen and wardrobe making areas. Over 20 players have started manufacturing these PVC designer sheets, referred to as PVC mica or PVC laminate, in India in last 4 years. Initially it started as an imported material from China, but slowly domestic brands accepted this product and created manufacturing supply and spreading among retailers in various cities. In last two years, the super high gloss effect of PVC sheets have been an attraction to consumers specially for kitchen and wardrobe areas, following the trend there are around 50 brands that are offering PVC laminates in India.

Originating from Mumbai based importers, PVC laminates are now more driven by Local produce such as MERAKI, SKYDECOR, AMULYA, ALSTONE, STANLEY, CROSSBOND, ADVANCE, ECHON, VIRGO, BLACK COBRA IMPRESSION, EURO BRIGHT, KALIDO, VIR, ALUTECH, MISTICA, SPARROW, CRYSTAL, SMART etc, are a few of the leading Indian brands in this segment. The leading imported PVC laminates brands are EURO PRATIK, DEXARTE, TREELAM, LAMINEX, KASHVI, BERGA, and TREND.

Given the availability of shades, colours and peppy designs, PVC laminates with the ability to bend 90 degrees and anti-scratch properties are giving good competition to the high gloss HPL category says many of the retail counters. With rising number of manufacturing companies and brands in India, the folders of PVC sheets are widely seen and awareness too is increasing. It is often discussed in trade that whether PVC laminates are taking some share of 1.0 mm decorative laminate category? Here’s a pan-India report on the growing charm of PVC laminates…

MARKET SURVEY ANALYSIS

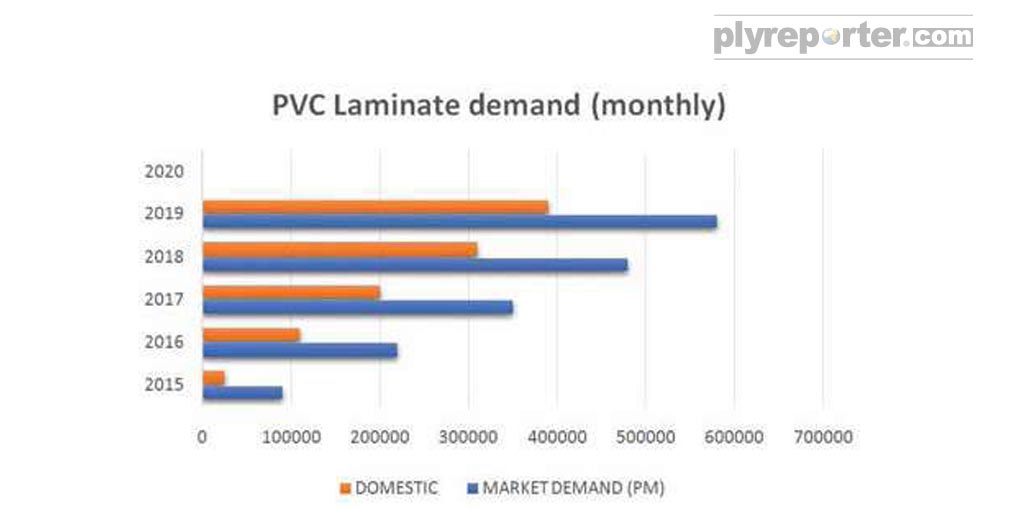

The Ply Reporter’s survey, (from 10 December, 2019 to 10 March, 2020) on PVC laminates industry and trade, found that with over two dozens of manufacturing units, India has approx. 7.5 lakhs sheets production capacity per month. With over 50 folders (domestic and imported) in this segment, Indian market consumes approx. 5 lakhs sheets per month, out of which imports is around 25%. Further, the brands offer decent margins to the retailers, and they are keen to display the products owing to their vibrant designs.

PVC laminates has come a long way since its launch in 2012 with India accounting for a major part of the sales. Being a decorative product, it has now become a vital pull product for all retailers pan-India. It has gained applications in kitchen shutters; small size furniture & kitchen makers in tier 2-3 cities and even in metro cities, though high end kitchen makers are still unsure of the product performance, feel that PVC laminate is very suitable for beautifying a simple set up into modern one. PVC laminate is helping the small size kitchen and wardrobe makers to offer a quick and new kind of design in a very short time that can quickly grab the eye balls of middle class customers. The retailers are selling these sheets calling them ‘Imported Luxury Laminates’ –whose finish, shine and designs are unmatched. The trade is of the opinion that PVC laminate is growing steadily because of its functionality and an affordable price band.

PVC LAMINATE MARKET

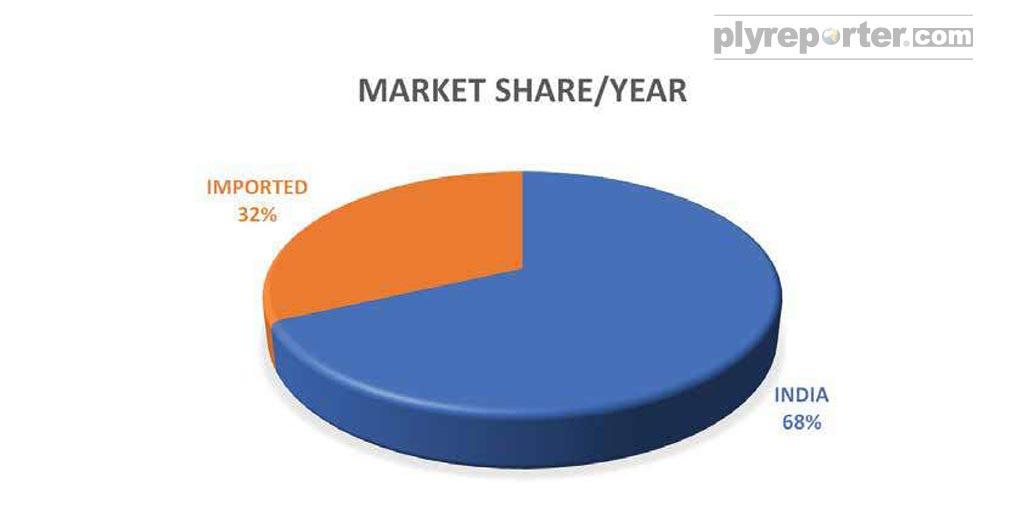

As per market surveys and research by Ply Reporter magazine, Indian manufacturers control around 75% of market share in PVC laminates category. The present volume for local manufacturing capacity is approx. 9 lakh sheets per month. The PVC laminate sector has been growing in double digits year on year though individual players growth is not consistent. There are more than 50 catalogues available in the Indian market where as India consumes more than 5 lakhs sheets every month.

The white and off-white sheets for balancing or liner account for 25% of the total sales and there could be a spurt in growth once real estate catches speed. Imported sheets market share has been dropping gradually with increasing number of domestic manufacturing enterprises. India has over two dozen domestic manufacturers where few players have more than 1 line of PVC laminate rolling.

WHEATHER, PVC LAMINATES EATING INTO THE SHARE OF 1.0 MM DECORATIVE LAMINATES ?

PVC laminates is eating away the share of 1.0 mm HPL sheets as price wise it is in the same bracket. The market is flooded with High gloss PVC sheets (designs) offered at Rs 1100 to Rs 1500, whereas high quality super gloss HPL sheets are available atRs 1900- Rs 2000 price band in retail.

As of now there are 22 manufacturing facilities operational across the country and by next year more number of new lines are coming up with expansion and better manufacturing capacity. The increasing manufacturing establishments in PVC laminate category indicate that it will be more competitive in the coming days, which will lead to more design options at lower price range. There are half a dozen players who have closed down or suspended their production.

The product is gaining market acceptance across the country; major sales is being witnessed in North due to multiple manufacturing facilities located in this region. The demand, for PVC laminates, in South India is growing and is majorly led by the modular furniture and kitchen industry.

According to retailers, attractive colours and designs supported by decent margin per sheet, makes it a good product to suggest to the customers. For many people, PVC sheets are substitute replacement of deco paint too. Wooden textured, plain solid colours with glitter, metallic, rustic and ash colours are in trend.

PVC LAMINATES APPLICATION

PVC laminates finds application in kitchen cabinets, wall decor, doors, TV cabinets and other interior applications. The USP of PVC Laminate is its 90 degree bendable feature. This makes it long-lasting, helps in covering the edges giving a finished look, and also saves time and money by removing edgeband applications in furniture making. Flashy, wide range of colour options, non-toxic, anti-borer, antitermite, fire retardant (with good quality material) and water proof area few other added advantage of PVC laminates.

Lately PVC laminates are being used like wall paper due to its aesthetics and better resistance to Indian weather and dust conditions. The availability of wide range of PVC laminates, colors and designs, etc, is giving edge to PVC sheets. Its application yields a different feel due to no use of edge-band tapes.

Even the designers/veneer buyers are using high gloss PVC sheets in showrooms and hotel lobby area. The availability of better quality glue in the market is also helping increase the demand of PVC laminate as it prevents the cracking issue. The way its application is growing in smaller markets; PVC laminate sheet market is bound to pose competition to HPL in the present scenario. However, on the quality front, PVC sheets are yet to build their trust among quality seekers.

ADVANTAGES AND CHALLENGES

PVC sheets derive its advantage from the ‘Colour Core Base’ characteristics. The colour core base is a product that has full sheet body in the same colour as on the top surface. The colour core base is helpful matching with top surface after little bit of sanding/smoothening. Initially colour core HPL was hard given the usage of paper; colour fading and getting easily moist were a few other concerns. Today the PVC laminate in its solid and metallic colours are in trend for kitchen shutters. Indian manufacturers are promoting their offerings different from imported one stating that their indigenous offerings are colour core product and is better than other and do not crack during application.

However, PVC laminate is not a suitable material for horizontal or traffic area surfaces application. It is not generally UV-stabilized, and therefore tend to turn yellow after a period of time. Further, as most of the designs are printed, colour variation is a common issue in PVC laminates. Designers complain that few brands had promised it to be anti-scratch product but have poor scratch resistance. That is why for high usability area like wardrobe, kitchen shutters at the bottom, table top, etc, are not the suitable areas of application. Further, while the products claim to be 90 degree bendable, the carpenters are not able to do so. This is primarily because the carpenters do not use the V grooving tool correctly for bending 90 degree and mishandling leads to breakage. Thus the USP of PVC laminates ‘90 degree bendable’ becomes a pain point due to illiteracy of carpenters.

There is also a perception that PVC laminates are plastic based and can easily catch fire. With major applications of PVC laminates in the kitchen space, this sounds risky. However, the fact is that be it individual house owners or project builders, they use good quality PVC laminates having fire retardant properties.

PVC Laminates Market in India

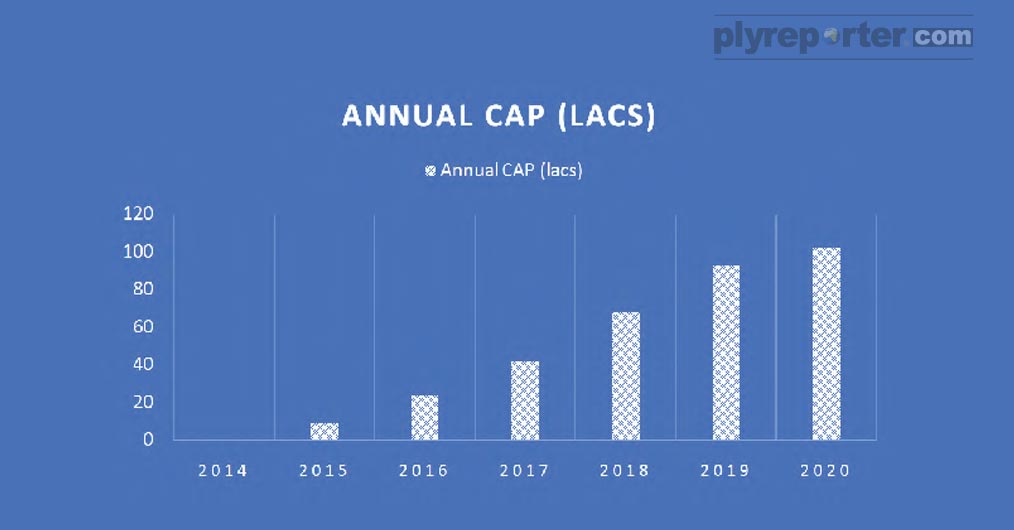

The Annual capacity of PVC laminate manufacturing has reached to 1.02 cr sheets which was almost Nil in 2014. The sharp and sudden rise in PVC laminate manufacturing indicates the adoptability and speed of India market. The Average capacity per month in 2020 was approximately around 8.5 lacs in the country..

The demand for PVC laminates in India has been growing steadily due to growing design choices and consumers preference for more shine and glossy material. The gloss level offered in PVC sheets has been major cause of demand drive among Indian interior surfacing needs. India consumes around 6 lacs sheets of PVC sheets every month that includes cheap white sheets too.

Today India has become a largely domestic manufacturing driven country, who has very least import dependency. The India market has largely lines sheets imports that are used in different applications. The import share also has high range designs of PVC sheets that are exclusively being imported by a dozen of import based brands in India..

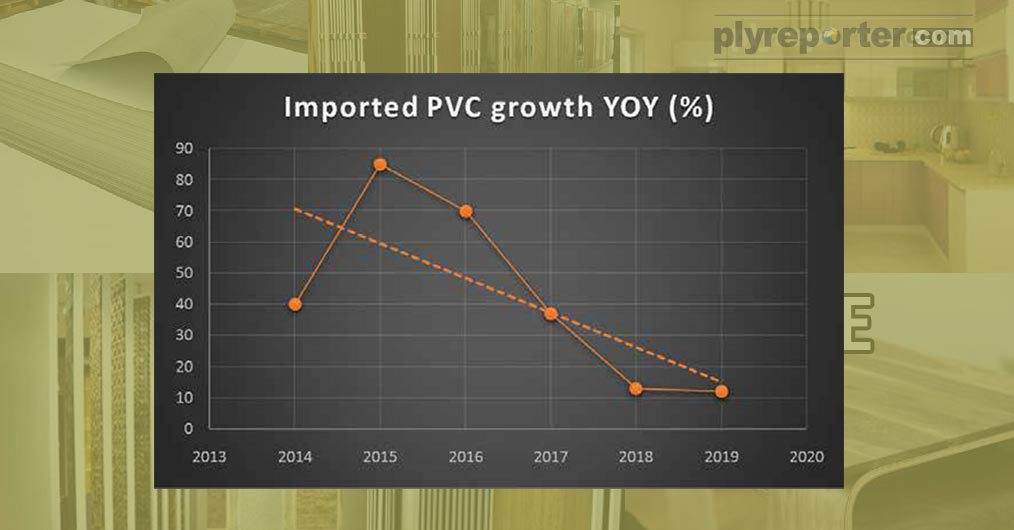

When PVC laminate started growing in India, it was 100 percent from import. In 2013 when Ply Reporter first reported about import of metallic look and feel PVC sheets, then it was all import. During 2015 import was growing at double rate yearly. Once the manufacturing line was installed in the country, the market share of import has been reducing. The graph shows the declining of imported sheets (estimates made on basis of % growth)