According to the Ministry of Finance the business with turnover of more than Rs 5 crore, the furnishing six-digit HSN code on invoice issued for the supplies of taxable goods and services has become mandatory from April 1, 2021. Earlier it was required up to 4 digits in the B2B invoices.

HSN code (Harmonised System of Nomenclature) has been issued with product categorization. It helps in systematic classification of goods across the globe. HSN codes for goods at 6 digits are universally common. Therefore, common HSN codes apply to Customs and GST.

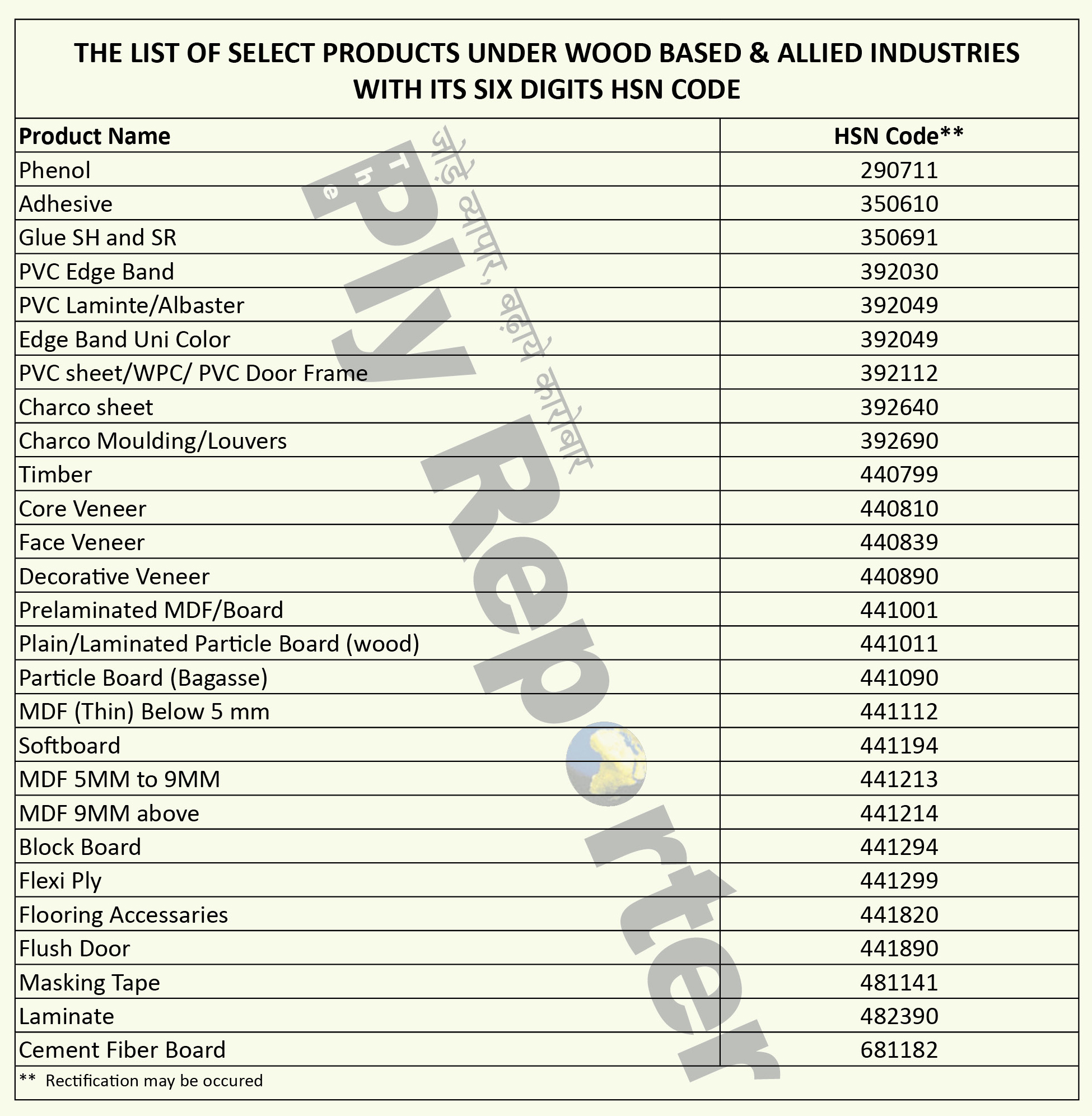

The list of select products under Wood panel and Decorative with its six digits HSN Code include -